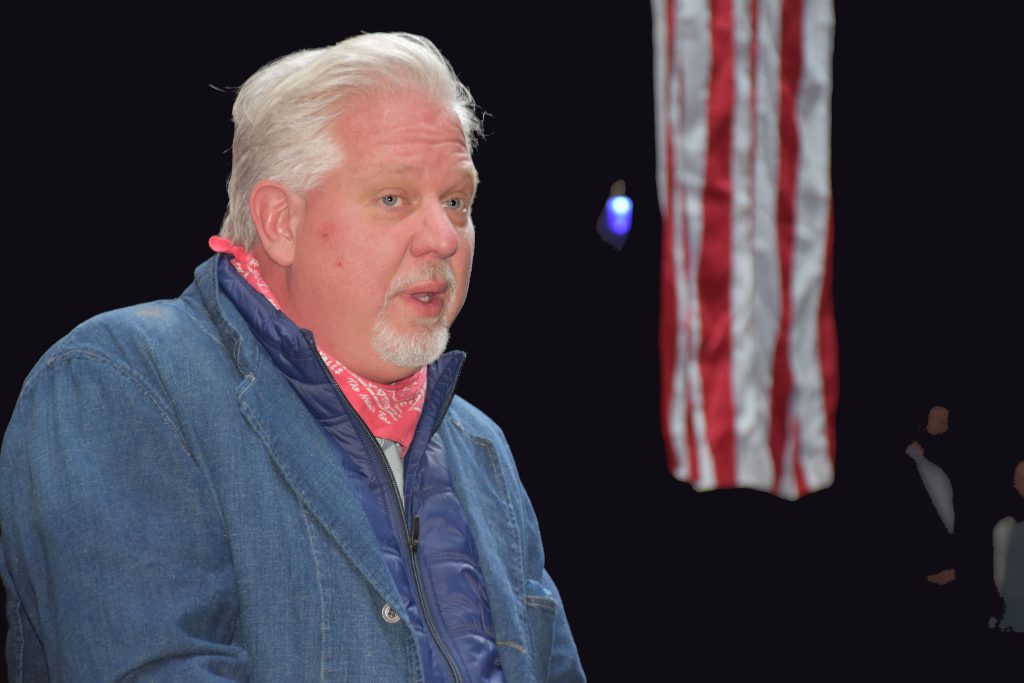

Media personality Glenn Beck condemned ESG scores while talking backstage at a Flag Day event hosted by the Cache GOP on Tuesday evening.

MILLVILLE – Media personality Glenn Beck told an enthusiastic crowd of about 600 Utahns that he liked them because “… you don’t suck.”

From Beck, the audience at Ridgeline High School on Tuesday evening took that as a compliment, just as the talk show host intended.

What does suck, he added, are ESG scores.

Simply explained, an ESG score is a measure of a company’s exposure to environmental, social and governance risks that are often overlooked during traditional financial analyses. These risks include things like energy efficiency, worker safety and board diversity, all of which can have significant financial consequences.

Speaking backstage prior to the Flag Day event hosted by the Cache GOP, Beck called ESG scores “pure evil.”

Less flamboyantly, Utah State Treasurer Marlo M. Oaks agreed.

“ESG is about controlling and forcing behaviors,” Oaks said. “It attempts to do through capital markets what activists and their government allies have been unable to do through democratic processes.

“It is a political score that, intentionally or not, can result in market participants using economic force to drive a political agenda.”

In April, Oaks joined with Attorney General Sean Reyes to send a letter to the Standard & Poor’s Global Ratings protesting Utah’s ESG score.

That letter was in response to S&P’s assigning Utah a “moderately negative” environmental score and “neutral” social justice and governance scores.

The letter was co-signed by Utah’s entire congressional delegation; state legislative leaders; Gov. Spencer Cox; and, the state’s constitutional officers.

“S&P should be concerned about whether investors will get paid back, not whether a state policy lines up with their political beliefs, whatever they may be,” the letter stated.

Eden Perry, S&P’s managing director of public finance ratings, defended Utah’s ESG scores in a letter dated May 16.

“Our ESG credit indicators for Utah reflect those ESG credit factors that we consider material to our analysis of Utah’s credit worthiness,” she wrote. “Accordingly, we cannot agree to your request to withdraw or to cease publishing ESG credit indicators for Utah.”

Oaks maintains that Utah has methodically and carefully managed revenues and debts over decades to earn a AAA credit rating, the best credit rating in the world.

“If ESG indicators take hold,” he warned, “investors or organizations like S&P Global may decide we extract ‘too much’ oil, or our gun laws are ‘too loose,’ or that we are to ‘too resistant’ to accept kindergarten sexual instruction.

“Financially material environmental and governance factors are already captured in traditional credit analysis. But ESG isolates and inappropriately weights political factors.”

On Tuesday evening, Beck stated that ESG scores are also being applied to individual citizens.

“If you’re a person and you go to your local school board and complain about (critical race theory),” he said, “you will get a ESG score … and you will lose your ability to get loans, insurance, you name it … This is happening in real time, right now.”

Beck is a leading American radio and television political commentator, where he is a staunch defender of the Constitution, individual liberties and traditional American values.

He is also a best-selling author.

Beck added that left-lending banks are also investing citizens’ 401k accounts in hair-brained Green New Deal solar and wind projects.

“They are using our own dollars to destroy us,” he said.

“I talked to your state treasurer Marlo Oaks the other day and he told me that Utah was pulling all of its state funds out of banks that apply ESG scores.”

In their letter dated April 21 to S&P Global, Utah’s leadership categorically objected to any ESG rating, ESG credit indicators or any other ESG factors separate from, in addition to or apart from traditional credit ratings.